Your Tax Problems

Unlock the Mystery of Your Tax Account: How Professional Taxpayer Account Reviews Reveal What the IRS Won’t Tell You

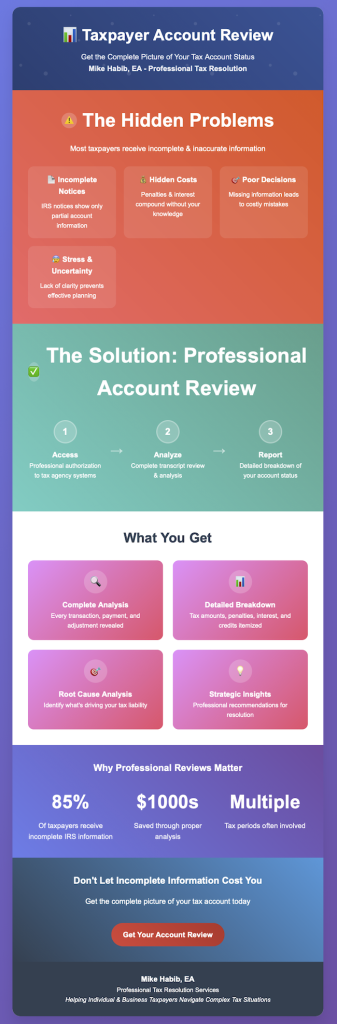

Tax season comes and goes, but for many Americans, questions about their tax accounts linger year-round. Whether you’re an individual taxpayer trying to understand a notice from the IRS or a business owner grappling with mounting penalties and interest charges, the information you receive from tax authorities is often incomplete, confusing, or downright inaccurate. This communication gap leaves taxpayers in the dark about their true financial standing with federal and state tax agencies.

Enter the game-changing solution that’s helping taxpayers across the country gain clarity and control over their tax situations: professional Taxpayer Account Reviews conducted by experienced tax professionals like Mike Habib, EA. This comprehensive service goes far beyond what taxpayers can access on their own, providing the detailed insights needed to make informed decisions about tax resolution strategies and financial planning.

If you are ready to proceed, contact us at 1-877-788-2937, or ONLINE.

The Information Gap That’s Costing Taxpayers Thousands

Most taxpayers operate under a dangerous assumption: that the IRS and state tax agencies provide complete and accurate information about their accounts. Unfortunately, this couldn’t be further from the truth. The notices and statements that taxpayers receive in the mail typically offer only a snapshot of their account status, often missing crucial details that could significantly impact their financial situation.

Consider the typical IRS notice. It might show a balance due, but it rarely explains how that balance was calculated, what specific tax periods are involved, or how penalties and interest have compounded over time. For business taxpayers, the situation becomes even more complex, with multiple tax types, quarterly obligations, and various penalties that can quickly spiral out of control without proper understanding.

This information deficit creates several problems for taxpayers:

Incomplete Understanding of Total Liability: Without a complete picture, taxpayers cannot accurately assess their true tax debt or develop effective resolution strategies. What appears to be a manageable balance might actually represent just the tip of the iceberg.

Missed Opportunities for Relief: Tax authorities don’t proactively inform taxpayers about available relief programs, penalty abatement opportunities, or errors in their accounts that could reduce their overall liability.

Poor Decision-Making: When operating with incomplete information, taxpayers often make decisions that worsen their situation, such as entering into payment plans that don’t account for continuing penalties and interest.

Increased Stress and Uncertainty: The lack of clear, comprehensive information creates anxiety and prevents taxpayers from moving forward with confidence in their financial planning.

What Is a Professional Taxpayer Account Review?

A Taxpayer Account Review is a comprehensive analysis of your complete tax account history with the IRS, state tax agencies, or other taxing authorities. Unlike the limited information available through standard taxpayer portals or the incomplete details provided in official notices, this professional service provides a complete, detailed breakdown of your tax account status.

During a Taxpayer Account Review, qualified tax professionals use their authorized access to tax agency systems to obtain your complete account transcript. This transcript contains information that goes far deeper than what’s available to taxpayers through standard channels. The review process involves analyzing every transaction, assessment, payment, and adjustment that has occurred on your account, often going back multiple years to provide a complete picture.

The resulting analysis provides taxpayers with a detailed account breakdown that includes:

- Exact tax amounts owed for each tax period

- Complete record of all payments and credits applied

- Detailed breakdown of penalties and interest assessed

- History of all account adjustments and corrections

- Status of any ongoing collection activities

- Documentation of compliance issues or missing returns

This level of detail is simply not available through standard taxpayer resources, making professional account reviews an invaluable tool for anyone dealing with complex tax situations.

The Hidden Costs of Incomplete Information

The financial impact of operating without complete tax account information can be staggering. Many taxpayers unknowingly make decisions that cost them thousands of dollars simply because they don’t understand their true situation.

Take the case of a small business owner who received an IRS notice showing a balance of $15,000. Based on this information, she entered into an installment agreement to pay off the debt over three years. However, a professional account review revealed that the notice didn’t include several quarters of employment tax liabilities, bringing her total debt to over $45,000. Worse yet, the continuing penalties and interest on the unreported amounts meant that her monthly payment plan wouldn’t even cover the ongoing accumulation of charges.

Another common scenario involves individual taxpayers who receive notices for specific tax years without understanding how those amounts relate to their overall tax situation. A taxpayer might focus on resolving a $5,000 balance for 2022 while remaining unaware that they have unfiled returns for 2020 and 2021 that could result in additional assessments of $20,000 or more.

These situations highlight the critical importance of understanding the complete picture before taking action on tax matters. Professional account reviews prevent these costly mistakes by ensuring that taxpayers have all the information needed to make informed decisions.

If you are ready to proceed, contact us at 1-877-788-2937, or ONLINE.

Root Cause Analysis: Finding the Source of Tax Problems

One of the most valuable aspects of a comprehensive Taxpayer Account Review is its ability to serve as a root cause analysis tool. Rather than simply addressing the symptoms of tax problems—the notices, the balances, the penalties—this service helps identify the underlying issues that created the tax liability in the first place.

For individual taxpayers, root cause analysis might reveal patterns such as:

- Withholding Issues: Discovering that insufficient tax withholding from wages or estimated tax payments has created a pattern of underpayment across multiple years.

- Reporting Errors: Identifying mistakes in tax return preparation or filing that have resulted in incorrect assessments.

- Life Event Impacts: Understanding how major life changes like divorce, job loss, or retirement have affected tax obligations in ways that weren’t properly addressed.

For business taxpayers, the analysis often uncovers more complex issues:

- Employment Tax Problems: Revealing systematic issues with payroll tax deposits or reporting that have compounded over time.

- Estimated Tax Shortfalls: Identifying insufficient quarterly payments that have resulted in penalties across multiple periods.

- Entity Structure Issues: Discovering how business structure changes or multi-entity relationships have created compliance complications.

By identifying these root causes, taxpayers can not only address their current tax problems but also implement changes to prevent similar issues from arising in the future. This proactive approach often saves taxpayers far more money than simply resolving the immediate problem would cost.

If you are ready to proceed, contact us at 1-877-788-2937, or ONLINE.

The Strategic Advantage of Complete Information

Armed with comprehensive account information, taxpayers gain significant strategic advantages in dealing with tax authorities and planning their financial futures. This complete picture enables several important benefits:

Accurate Resolution Planning: With exact balances and a complete understanding of how penalties and interest are accumulating, taxpayers can develop realistic resolution strategies. Whether negotiating an offer in compromise, setting up a payment plan, or pursuing penalty abatement, having complete information is essential for success.

Informed Negotiation: Tax professionals can negotiate more effectively with tax agencies when they have complete account information. Rather than operating on assumptions or incomplete data, they can present accurate analyses that support their clients’ positions.

Proper Priority Setting: When dealing with multiple tax issues, complete account information helps prioritize which problems need immediate attention and which can be addressed over time. This prevents taxpayers from wasting resources on minor issues while major problems continue to grow.

Future Planning Integration: Understanding the complete tax account status allows for better integration of tax resolution strategies with overall financial planning. Taxpayers can make informed decisions about business operations, investment strategies, and personal financial planning with full knowledge of their tax obligations.

Beyond Federal Taxes: State and Local Tax Account Reviews

While much attention focuses on federal tax issues, state and local tax obligations can be equally complex and problematic. Many states have their own unique penalty structures, compliance requirements, and collection procedures that can create significant liabilities for unwary taxpayers.

Professional Taxpayer Account Reviews extend beyond federal taxes to include comprehensive analysis of state income taxes, sales taxes, property taxes, and other local tax obligations. This comprehensive approach is particularly valuable for:

- Multi-State Businesses: Companies operating in multiple states often struggle to track compliance across different jurisdictions with varying requirements and deadlines.

- Remote Workers: The rise of remote work has created complex state tax obligations for many individuals who may owe taxes in states where they’ve never physically lived.

- Property Owners: Real estate investors and property owners may have tax obligations in multiple jurisdictions that require careful tracking and management.

State and local tax issues can be particularly problematic because these agencies often have more aggressive collection procedures than the IRS, including the ability to suspend business licenses, place liens on property, and garnish wages with less procedural protection for taxpayers.

The Technology Behind Comprehensive Account Reviews

Modern Taxpayer Account Reviews leverage sophisticated technology and professional access to provide unprecedented detail about tax account status. Qualified professionals like Enrolled Agents have authorized access to tax agency computer systems that provide real-time information about account status, recent transactions, and pending actions.

This technology access enables several advanced capabilities:

Real-Time Account Monitoring: Professional systems can track changes to tax accounts as they occur, ensuring that taxpayers have up-to-date information for decision-making purposes.

Historical Transaction Analysis: Advanced review tools can analyze years of account history to identify patterns, errors, and opportunities that might not be apparent from individual notices or statements.

Cross-Reference Verification: Professional systems can cross-reference information across different tax types and periods to identify inconsistencies or missing information that could impact overall liability.

Automated Alert Systems: Many professional services include ongoing monitoring that alerts taxpayers to significant changes in their account status, ensuring that problems are addressed quickly before they escalate.

Making Sense of Complex Penalty Structures

One of the most confusing aspects of tax account management involves understanding how penalties and interest are calculated and applied. Tax agencies use complex penalty structures that can multiply the impact of even small tax obligations over time.

Professional Taxpayer Account Reviews provide detailed analysis of penalty calculations, including:

Penalty Types and Rates: Different types of tax obligations carry different penalty structures. Understanding which penalties apply to specific tax periods and how they’re calculated is essential for accurate liability assessment.

Interest Compounding: Tax agencies typically compound interest daily, which means that small balances can grow quickly if not properly managed. Professional reviews provide exact calculations of interest accumulation and projections for future growth.

Penalty Abatement Opportunities: Many taxpayers are unaware that certain penalties can be abated or reduced based on specific circumstances. Professional reviews identify these opportunities and provide the documentation needed to pursue them.

Payment Application Strategies: Understanding how payments are applied to tax accounts can significantly impact the overall cost of resolving tax problems. Professional reviews help optimize payment strategies to minimize interest and penalty accumulation.

The Human Element: Professional Interpretation and Strategy

While technology provides the raw data for comprehensive account reviews, the human element remains crucial for interpreting this information and developing effective strategies. Experienced tax professionals bring several valuable capabilities to the process:

Pattern Recognition: Experienced professionals can quickly identify patterns in tax account data that indicate specific problems or opportunities. This pattern recognition often reveals issues that would be missed by less experienced reviewers.

Regulatory Knowledge: Tax laws and procedures are constantly changing, and experienced professionals stay current with these changes to ensure that their analysis reflects the most recent requirements and opportunities.

Strategic Thinking: Beyond simply reporting account status, professional reviewers develop strategic recommendations tailored to each taxpayer’s specific situation and goals.

Communication Skills: Perhaps most importantly, experienced professionals can translate complex tax account information into understandable terms that enable taxpayers to make informed decisions about their situations.

Taking Action: The Path Forward

For taxpayers struggling with complex tax situations or simply seeking clarity about their account status, professional Taxpayer Account Reviews represent a critical first step toward resolution and peace of mind. The investment in comprehensive account analysis typically pays for itself many times over through improved decision-making, identification of cost-saving opportunities, and prevention of costly mistakes.

The process begins with gathering the necessary authorization documents and basic account information. From there, qualified professionals can typically provide comprehensive account reviews within a few business days, delivering detailed analyses that form the foundation for effective tax resolution strategies.

Whether you’re an individual taxpayer confused by IRS notices or a business owner struggling with complex multi-state tax obligations, don’t let incomplete information drive your decisions. Professional Taxpayer Account Reviews provide the clarity and comprehensive understanding needed to take control of your tax situation and move forward with confidence toward resolution and compliance.

The path to tax resolution begins with understanding exactly where you stand—and professional account reviews provide that critical foundation for success.

If you are ready to proceed, contact us at 1-877-788-2937, or ONLINE.