Your Tax Problems

Orange County, CA Residents and Businesses can Release a Tax Levy in One Day and Fix IRS Problems Without High Tax Lawyer Fees

Do you have a tax levy, such as a wage garnishment for unpaid taxes? Have you been visited by an IRS agent or received a notice of payment due? Are you searching for tax defense and relief from a specialist in tax resolution but can’t pay the high cost of a tax attorney? If you answered yes, there is good news for you.

You Don’t Need to Pay a Tax Attorney to Resolve Your Tax Problems

As an IRS Enrolled Agent (EA), I am licensed by the US government to represent Orange County taxpayers before the IRS, release and remove your tax levy and wage garnishment, settle your debt, prepare your back taxes, and help you achieve a fresh start.

I work personally and confidentially with every client at a reasonable flat fee quoted up front and will get you the same resolution and relief as high-cost tax attorneys one would find in Newport Beach, Laguna Beach, or Irvine who charge $300–$1,000 per hour.

I have personally represented 2,000 taxpayers over the past 20 years before the IRS.

Only CPAs, tax lawyers, and Enrolled Agents (EA) are allowed to talk to the IRS on your behalf.

Enrolled Agents, however, are the only tax professionals who are licensed by the US government and who specialize in tax resolution.

Your CPA may know how to prepare your tax return, but he may not know all of the IRS or FTB resolution options when you can’t pay your taxes.

I specialize in tax relief and resolution.

A tax attorney is a good choice for defending you in rare cases of tax evasion and fraud or when you want to sue the IRS; but in the case of removing tax levies, settling tax debt, and other tax problems with the IRS, BOE, FTB and EDD, an Enrolled Agent is the specialist you need to represent you at reasonable cost.

My firm is an A+ accredited member of the Better Business Bureau and an endorsed local provider (ELP) by Former Dave Ramsey ELP 2012-2019.

Please call us at 877-788-2937 or contact us for a free, personal and confidential consultation with me, a licensed Enrolled Agent.

You’re Not Alone—We Can Help

More people live in OC than 21 US states—about three million people. This includes residents of Brea, Yorba Linda, Fullerton and La Habra in the north; San Clemente, San Juan Capistrano, and Dana Point in the South; Newport Beach, Huntington Beach, and Seal Beach in the west; Lake Forest, Mission Viejo, and Rancho Santa Margarita in the East; and Santa Ana, Costa Mesa and Irvine in the center—just to name some of the beautiful cities of this region.

It is certain that several thousand residents throughout Orange County have IRS problems, such as tax levies, wage garnishments, property seizures, past due tax returns, unfiled taxes, and IRS tax audits.

In its business economy, the county has a very low unemployment rate of 4% and added 55,000 jobs in the 2014-2015 fiscal year alone. That’s a lot of employers providing needed jobs, yet it is also certain that some of these business owners need tax liens or levies removed or have received audit notices by the FTB, BOE, and EDD.

It may seem easy to ignore the government’s demand for payment, but waking up to an empty bank account or a repossession is very difficult. In addition to tax levies, tax liens, and wage garnishments, some cases are referred to the IRS criminal investigation division and can result in imprisonment. Sometimes an officer or agent of the IRS, FTB, BOE, or EDD will even visit your office or home.

The fact is, failure to file tax returns is a felony and subject to criminal and civil penalties.

However, in my 20 years providing tax preparation and tax resolution services, the main reasons people need tax levies removed, unfiled tax return preparation, and other tax defense services are due to major life events, such as divorce, grief, unemployment, bankruptcy, medical, physical, and emotional issues, or simply procrastination and ignorance.

Whatever your life situation is, you do not have to go another day or another year with the added stress of tax levies, tax liens and other IRS problems in your life—and you do not need to pay $300+ an hour to a tax attorney for help.

Please call us at 877-788-2937 or contact us for a free, personal and confidential consultation with a licensed Enrolled Agent, who charges an affordable flat fee to resolve your case.

TAX PROBLEMS WE RESOLVE

Orange County Tax Audits, Tax Liens, Tax Levies, and Wage Garnishments

In 2014 throughout the US, the IRS filed over 535,000 tax liens, requested 1,995,000 tax levies on third parties, and conducted 432,000 seizures through Field Collection programs.

You don’t have to become one of these statistics.

A tax lien is a claim attached to your assets, such as bank account, wages, or real estate that allows the IRS, FTB, BOE or other entity to seize your property to pay off the debt owed.

A tax levy is the actual seizure of your property to pay the debt, such as a wage garnishment.

Ignoring tax liens and notice of tax levies only result in much higher fines and stress than is necessary. You have options, such as presenting an offer in compromise, installment plan, CNC-Currently non-Collectible status, and others.

But you should not try to release a tax levy or resolve your IRS issues alone.

Contact a licensed Enrolled Agent endorsed by Former Dave Ramsey ELP 2012-2019, who specializes in tax lien and levy removal for personal and quick relief.

Past Due and Unfiled Tax Returns for Orange County Individuals and Businesses

Whatever your reason is for not filing in the past, it is time to prepare and file now before you lose any refunds or tax credits due to you, and before the IRS places tax levies against your assets or seizes your property.

The sad fact is that the IRS has no deadline to collect taxes from you, but they will only refund any taxes owed to you for the past three years. For example, if you have not filed taxes for five years, you can still file your tax return and get any refunds due to you only for the past three years but not for the fourth or fifth year.

The longer you wait, the more late penalties build up and the more likely you will get a letter from the IRS asking for payment within 10 days, or even an audit.

If you have already received an IRS letter, ignoring it will only result in unnecessarily high penalties and legal costs. But you have a safe alternative—talk to me, Mike Habib, Enrolled Agent.

I specialize in tax resolution and am licensed by the federal government to represent you before the IRS in your tax defense, so that you can become compliant with the IRS.

You can remove the fear and anxiety of unfiled back tax returns, pass through the audit process, and overcome other IRS tax problems from your life.

Mike’s Personal Promise

“I promise that I will resolve your tax problem,

and negotiate the lowest settlement allowed by law.”

California Franchise Tax Board—FTB Tax Help for Orange County Businesses

The FTB annually reviews more than five million state and IRS income tax records, as well as records from the EDD, the BOE, financial institutions, and city business tax information.

If you have not filed your state income tax, the FTB will decide how much you owe based on the information they gathered, and give you 30 days to pay or prove that you do not owe that amount.

If you have received a letter from the California Franchise Tax Board and/or need other kinds of tax resolution services, call us today for a free confidential consultation to assess your situation and receive advice on how to proceed.

Board of Equalization—BOE Tax Help for Orange County Businesses

Has the BOE sent you a demand for payment or placed a lien on your property for back taxes?

With almost 90,000 non-family owned establishments in OC, you may feel singled out, but tax audits and levies happen to small and large businesses alike throughout California and the US.

In certain cases, the BOE will allow you to offer a compromise on the amount owed. But be careful. Not all offers are accepted. Let a specialist in tax preparation and resolution for businesses with an A+ rating at the Better Business Bureau, represent your business at the BOE and negotiate a settlement on your behalf.

For a FREE confidential and professional consultation, call us at 877-788-2937 or contact us to schedule an appointment.

Employment Development Department—EDD Tax Help for Orange County Businesses

Have you received a payroll tax audit notice by the EDD or have payroll tax 941 tax problems? We know the payroll tax code and can represent your business before the EDD. We can also negotiate an effective tax debt resolution.

We handle all of the details of the audit process and negotiation to free you up to do what you do best—run your business.

Learn what to expect during the EDD audit process and then call me, Mike Habib, EA, an accredited member of the BBB better business bureau with an A+ rating. I am also an Endorsed Local Provider (ELP) by Former Dave Ramsey ELP 2012-2019, the TV and financial expert and am an active member of CSEA — California Society of Enrolled Agents, and NAEA — National Association of Enrolled Agents.

With a total employment of about 1,350,000 OC employees, there’s a lot of possibilities for conflict with the IRS.

Speak with me for a free, confidential consultation by calling 877-788-2937 between 8 am and 8 pm Monday through Friday.

You Are Not Alone!

Within 790 square miles, Orange County is home to a little over three million people, with about 1.5 million employees.

This includes about 25 unincorporated areas, such as Coto de Caza, East Irvine, Ladera Ranch, Las Flores, Orange Hills, Rossmoor, Santa Ana heights, Trabuco Canyon, and Tustin Foothills, to name a few.

I remove tax levies and resolve tax problems throughout these unincorporated areas and all cities of Orange County, including Anaheim, Brea, Irvine, Santa Ana, Newport Beach, Seal Beach, Laguna Hills, Tustin, Yorba Linda, Fullerton, and Lake Forest.

I will help you prepare and file your back tax returns and resolve any IRS tax problems, so you can live free of fear of the IRS.

Here are steps to get started:

- Educate yourself about the IRS tax resolution services available to you.

While you may have heard of the Offer in Compromise (OIC), to settle your tax liabilities and even though the IRS changed the guidelines in 2012 to make it easier to qualify, you are not guaranteed acceptance. In 2014, only 40% of taxpayer who applied for OIC relief were accepted. Not only do tax payers try to negotiate these OIC agreements on their own, they also attempt to work through the IRS audit process alone. Whether it’s through the mail, at home visits, or in-office visits, IRS auditors are trained to get information from you that you do not need to give and to get dollars from you that you may not actually owe them. - Get help from a highly reputable, experienced, and licensed tax resolution specialist.

I am an Enrolled Agent (EA) and have represented 2,000 taxpayers over the past 20 years before the IRS. Only CPAs, attorneys, and Enrolled Agents (EA) are allowed to talk to the IRS on your behalf, Enrolled Agents, however, are the only tax professionals who are licensed by the US government and who specialize in tax resolution. Your CPA or attorney may not know the IRS as well as I do. I will acquire a power of attorney to represent you in your place so you do not have to be intimidated or face the fear of the unknown and complicated issues involved in your tax problems.

ORANGE COUNTY TAX STATS

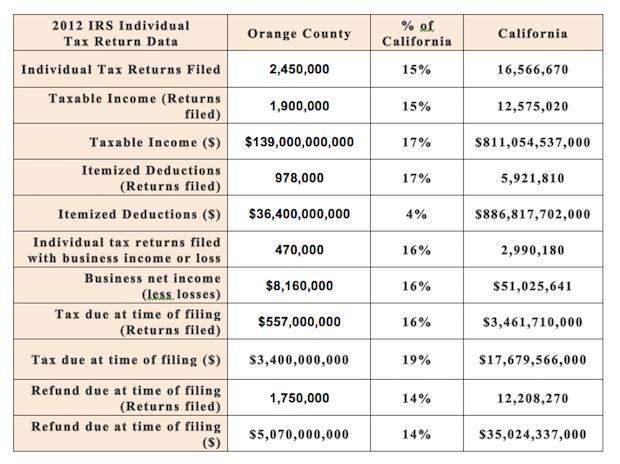

With a median household income of $75,000, Orange County residents contributes significantly to the state’s income tax revenue.

See exactly how much OC individuals and businesses add to the IRS income stream compared to the rest of California:

Orange County and California IRS Tax Data

ORANGE COUNTY FAST FACTS

- The first European settlements in the OC were land grants given to Jose Manuel Nieto and Jose Antonio Yorba. Their ranches were known as Rancho Santiago de Santa Ana (which became part of the Irvine Ranch) and Rancho Los Nietos.

- The Nieto heirs were granted more land in 1834, which became Rancho Los Alamitos, Rancho Las Bolsas, and Rancho Los Coyotes.

- After the Mexican-American War, James Irvine who became part owner of Rancho Santiago de Santa Ana, bought out the other partners’ interests. His son, James Irvine Jr., incorporated the ranch into The Irvine Company.

- In 1959, The Irvine Company sold 1,000 acres of the ranch to the state of California for $1 to build a university.

- Pacific City changed its name to Huntington Beach to honor Henry Huntington, president of the Pacific Electric trolley that connected Los Angeles with Santa Ana and Newport Beach in 1904. The trolley brought much needed economic vitality to the region as well as weekend visitors from the upper echelon of early Hollywood.

- Santa Ana Canyon Ranch was originally a land grant to the Yorba heirs, Bernardo and Teodosio.

- In 1954, I-5 construction completed, just in time for Disneyland’s grand opening in 1955, which now employs about 27,000 cast members in Anaheim.

- While OC has many lakes, the only natural lakes are located in Laguna Beach, which are formed from groundwater rising up along an underground fault.

- Anyone can take their car for a ride on the Balboa Island Ferry that operates every five minutes between Balboa Peninsula and Balboa Island in Newport Beach.

- For a nostalgic blast to the past amidst the trendy, upscale southern OC, Old Town in the City of Orange offers residents and visitors a quaint day of shopping and eating.

- The most famous resident, other than possibly John Wayne and Holocaust survivor and author Corrie Ten Boone, would be Richard Nixon who was born in Yorba Linda (where his library is located) and lived in San Clemente after his presidency. Built by San Clemente founder Ole Hanson in 1926, his “Western White House” 5.4-acre estate went up for sale in April 2015 for $75 million.

My office is located between the 57 and 605 freeways, near north Orange County, easy to reach via the 5, 91 and 405 freeways. I look forward to meeting you.

1US Census Quick Facts – Population Estimate, 2013, accessed May 18, 2015

2Orange County Business Climate Snapshot

3SOI Tax Stats – Delinquent Collection Activities – IRS Data Book Table 16 – Delinquent Collection Activities, Fiscal Years 2013 and 2014, accessed May 12, 2015.

4US Census Quick Facts – Private nonFam Establishments, 2013, accessed May 12, 2015

5US Census Quick Facts – Total Employment, 2012 accessed May 12, 2015

6US Census Quick Facts – Land area in square miles, 2010; Total Employment, 2012 accessed May 12, 2015

7US Census Quick Facts – Median Household Income, 2009-2013

8SOI Tax Stats – Individual Income Tax Statistics – 2012 ZIP Code Data taken from IRS, Statistics of Income Division, Individual Master File System, updated July 2014, accessed May 12, 2015.

9These facts were gathered from Wikipedia articles on Orange County, Irvine, and Richard Nixon.