Your Tax Problems

About Us

Mike Habib, EA

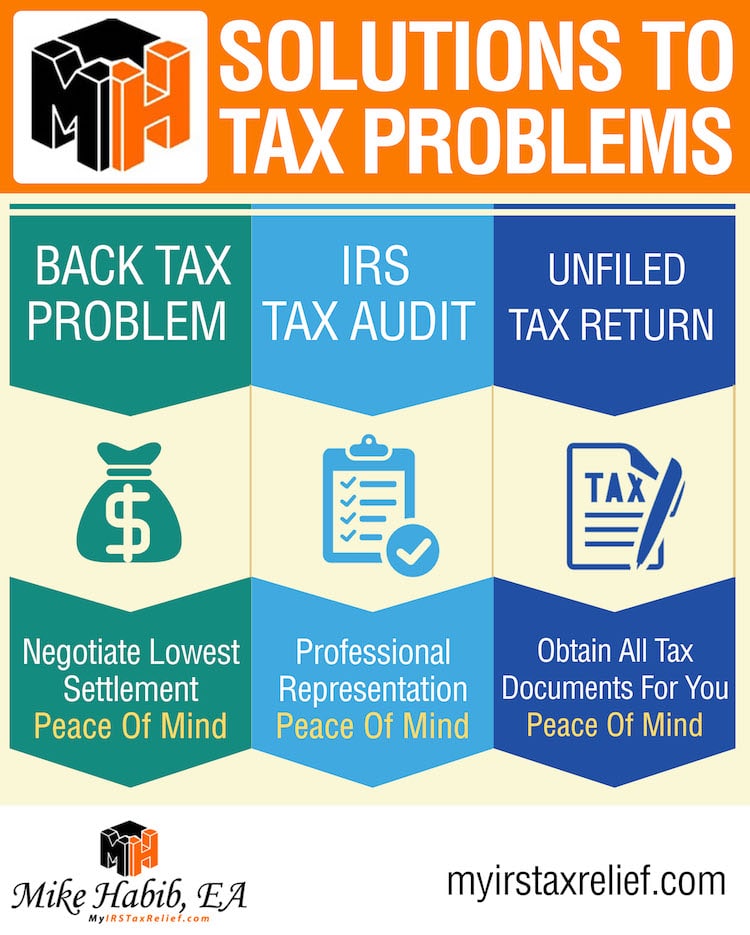

Solutions to Tax Problems

I am an IRS licensed Enrolled Agent who concentrates on helping individuals and businesses resolve their IRS and or State tax problems.

I have over 20 years experience in taxation and financial advisory to individuals, small businesses and fortune 500 companies.

I have solutions to your tax problems.

- I handle each client’s case personally and attempt to successfully negotiate the best possible solution for him or her.

- Free initial phone consultation so that I can gather the facts and determine what options are available for you. Additional consultations are prepaid at our reduced rate of $100 for up to 20 mins.

- Evening and weekend appointments for clients that cannot meet with me during the week.

- Let me take the burden off your shoulders.

Personal Promise

I promise that I will resolve your tax problem, and negotiate the lowest settlement allowed by law.

IRS problems do not go away unless you take some action! Get IRS Tax Help today by calling me at 877-788-2937 You can reach me at this number from 8:00 am to 8:00 pm, 7 days a week.

- Los Angeles Tax Services – EA, CPA, Tax Relief Law

- Mike Habib, EA the Premier Choice for Comprehensive Tax Resolution Services: Specialty Expertise Over Local Limitations

- Mike Habib, EA: A Trusted National Leader in Tax Representation and IRS Relief Services

What is an Enrolled Agent?

An Enrolled Agent (EA) is a federally-authorized tax practitioner who has technical expertise in the field of taxation and who is empowered by the U.S. Department of the Treasury to represent taxpayers before all administrative levels of the Internal Revenue Service for audits, collections, and appeals.

What Does the Term “Enrolled Agent” Mean?

“Enrolled” means to be licensed to practice by the federal government, and “Agent” means authorized to appear in the place of the taxpayer at the IRS. Only Enrolled Agents, attorneys, and CPAs may represent taxpayers before the IRS. The Enrolled Agent profession dates back to 1884 when, after questionable claims had been presented for Civil War losses, Congress acted to regulate persons who represented citizens in their dealings with the U.S. Treasury Department.

What are the Differences Between Enrolled Agents and Other Tax Professionals?

Only Enrolled Agents are required to demonstrate to the IRS their competence in matters of taxation before they may represent a taxpayer before the IRS. Unlike attorneys and CPAs, who may or may not choose to specialize in taxes, all Enrolled Agents specialize in taxation. Enrolled Agents are the only taxpayer representatives who receive their right to practice from the U.S. government (CPAs and attorneys are licensed by their state). How can Enrolled Agent help me?

Enrolled Agents advise, represent, and prepare tax returns for individuals, partnerships, corporations, estates, trusts, and any entities with tax-reporting requirements. Enrolled Agents’ expertise in the continually changing field of taxation enables them to effectively represent taxpayers audited by the IRS. Member of:

Member of the California Society of Enrolled Agents Better Business Bureau Member of the National Association of Enrolled Agent