Your Tax Problems

IRS Penalty Abatement Letter

Are you shocked by the stiff penalty amount? The IRS assesses different types of penalties and interest on unpaid back taxes. You can write up a letter requesting penalty abatement for reasonable cause.

If you have not paid your entire federal taxes, or have not reported your entire income, or filed your returns late then the IRS – Internal Revenue Service will tack on excessive penalties and interest. The IRS gives you an option whereby these penalties can be forgiven or abated. Though you are still held responsible for any outstanding taxes you owe, the Internal Revenue Service can possibly forgive your penalties on the unpaid taxes if you make a letter requesting for abatement that is acceptable.

Call us today at 877-788-2937.

When can the Internal Revenue Service abate your tax penalties?

Your letter request for penalty abatement can only be granted by the IRS if you can prove “reasonable cause” or good reasons for not paying your past due taxes in full.

What are the various reasons for to which your delinquent taxes can be abated?

The IRS may grant your letter request of abatement for the following reasons:

- Due to a family member’s death.

- Serious or chronic illness of you or any of your family members.

- Severe environmental disturbances such as a flood or a hurricane.

- The IRS or your tax advisor has given you incorrect advice.

- Not being able to pay though you tried to take ordinary care in your business operations.

- Uncontrollable reasons at your end that did not let you determine the due taxes.

- Any other reasons though you had tried your best using an ordinary business care.

What is the penalty abatement letter process?

If you could not pay your delinquent taxes due to any of the reasons mentioned above, you could be a good candidate for penalty abatement by just asking the Internal Revenue Service for it via penalty abatement letter. You need to draft a detailed “request for abatement” by writing a ‘penalty abatement request letter’ to the Internal Revenue Service. Along with it, you have to also enclose a copy of the IRS’s notice and any other written documentation to support the reasons for which you are making the penalty abatement request. You also need to complete IRS Form 843 (request for abatement and claim for refund) and enclose it with your request letter. Moreover, if you can do so, you may send your delinquent taxes’ payment (though not mandatory) while you are sending your penalty abatement request letter to the Internal Revenue Service.

We assist our clients in professionally drafting penalty abatement letters, by stating the specific facts & circumstances, tax laws, and argument to accept the abatement request. Call us today at 877-788-2937.

IRS statistics on penalties:

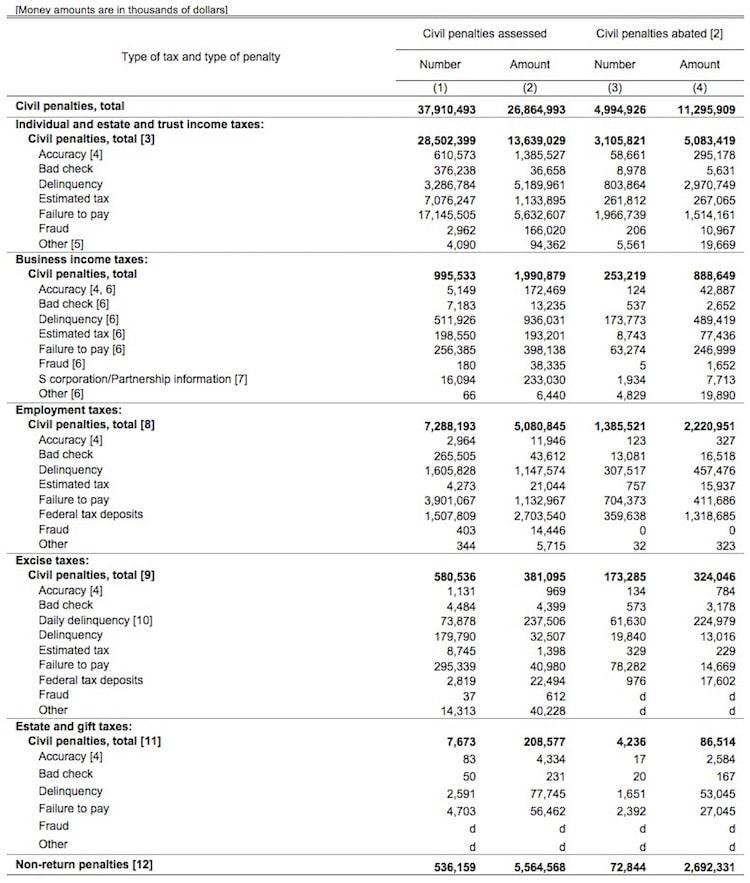

Table 17. Civil Penalties Assessed and Abated, by Type of Tax and Type of Penalty, Fiscal Year 2012 [1]

d—Not shown to avoid disclosure of information. However, the data are included in the appropriate totals.

[1] Assessments and abatements of penalties included here were recorded in Fiscal Year 2012 regardless of the tax year to which the penalty may apply.

[2] An abatement is a reduction of assessed penalties. The IRS may approve an abatement of a penalty for: IRS error; reasonable cause; administrative and collection costs not warranting collection of penalty; discharge of penalty in bankruptcy; and the IRS’s acceptance of partial payment of assessed penalty.

[3] Represents penalties associated with the Form 1040 series (individual income tax return series) and Form 1041 (estate and trust income tax return).

[4] Represents penalties for negligence; substantial understatement of income tax; substantial valuation misstatement; substantial overstatement of pension liabilities; substantial estate or gift tax valuation understatement (under Internal Revenue Code section 6662); understatement of reportable transactions (under Internal Revenue Code section 6662A); and underpayment of stamp tax (under Internal Revenue Code section 6653).

[5] Represents penalties related to failure to supply taxpayer identification number and failure to report tip income.

[6] Represents penalties associated with the Form 1120 series (corporation income tax return series) and Form 990–T (tax-exempt organization unrelated business income tax return).

[7] Represents penalties associated with failure to provide information on Forms 1065 (partnership return) or 8752 (required payment or refund for an S corporation or partnership under Internal Revenue Code section 7519), or failure to file electronically Form 1065–B (large partnership return).

[8] Represents penalties associated with Forms 940 (employer’s Federal unemployment tax return); 941 (employer’s tax return for income and Social Security taxes withheld for other than household and agricultural employees); 943 (employer’s tax return for agricultural employees); 944 (employer’s tax return); 945 (tax return for withheld income tax from non-payroll distributions); 1040, Schedule H (household employment taxes); 1042 (tax return of withheld income tax on U.S.-source income of foreign persons); and CT–1 (railroad retirement tax return).

[9] Represents penalties associated with Forms 11–C (occupational tax and registration for wagering return); 720 (excise tax return); 730 (excise tax return for wagering); 990 (tax-exempt organization information return); 990–PF (private foundation return); 1041–A (information return of charitable contribution deductions by certain trusts); 2290 (heavy highway vehicle use tax return); 4720 (excise tax return of charities and other persons); and 5227 (split-interest trust information return).

[10] Represents penalties under Internal Revenue Code sections 6652(c)(2)(A) and (B) related to tax-exempt organizations or trusts. Penalties are assessed on a daily basis for failure to file Forms 990 (tax-exempt organization information return); 1041–A (information return of charitable contribution deductions by certain trusts); 1120–POL (income tax return for certain political organizations); 5227 (split-interest trust information return); or 8886–T (disclosure by tax-exempt entity regarding prohibited tax shelter transaction).

[11] Represents penalties associated with Forms 706 (estate tax return) and 709 (gift tax return).

[12] Represents various penalties assessed and abated for a wide range of noncompliant behaviors, such as noncompliance related to tax return preparers and to information returns (e.g., Forms 1099, W–2, 3520–A, 8027, and 8300), as well as aiding and abetting; frivolous return filings; and misuse of dyed fuel. Also includes trust fund recovery penalties. Withheld income and employment taxes, including Social Security taxes, railroad retirement taxes, or collected excise taxes, are collectively called trust fund taxes because employers actually hold the employee’s money in trust until they make a Federal tax deposit in that amount. Trust fund recovery penalties are assessed when these employment taxes are not collected, accounted for, and paid timely. The amount of trust fund recovery penalties credited in Fiscal Year 2012 was $880,037 thousand and is included in the amount abated.

NOTE: Detail may not add to totals because of rounding.

SOURCE: Chief Financial Officer, Financial Management.